furfamarket.ru

News

Money Market Rates Bankrate

A money market savings account that offers no monthly fees, is FDIC insured to make sure your money is protected, and earns a great interest rate. Savings Rates ; Money Market IRA, $, $ - $ ; $, $ - $4, ; $, $5, - $9, ; $, $10, - $24, Bankrate's picks for the top jumbo money market rates · First Internet Bank – % APY, $1,, minimum balance for APY · America First Credit Union – Earn interest and use uninvested cash to purchase investments and manage daily expenses Learn more. SCHWAB BANK INVESTOR CHECKING™, LINKED. Our variety of high-yield savings accounts can help you meet your savings goals. Please contact a local branch for current money market rates. 1. Annual. Annual Percentage Yields (APYs) are accurate as of 04/08/ APY/rate may change at any time before or after the account is opened. The APY varies with the. According to the Federal Deposit Insurance Corporation (FDIC), the average money market rate is % as of August 19, Below is a look at the average. % APY Month Term Certificate Of Deposit; % APY High Yield Money Market Account. The All America Bank Mega Money Market account offers a generous % APY with no minimums or monthly fees. The account allows for six fee-free withdrawals or. A money market savings account that offers no monthly fees, is FDIC insured to make sure your money is protected, and earns a great interest rate. Savings Rates ; Money Market IRA, $, $ - $ ; $, $ - $4, ; $, $5, - $9, ; $, $10, - $24, Bankrate's picks for the top jumbo money market rates · First Internet Bank – % APY, $1,, minimum balance for APY · America First Credit Union – Earn interest and use uninvested cash to purchase investments and manage daily expenses Learn more. SCHWAB BANK INVESTOR CHECKING™, LINKED. Our variety of high-yield savings accounts can help you meet your savings goals. Please contact a local branch for current money market rates. 1. Annual. Annual Percentage Yields (APYs) are accurate as of 04/08/ APY/rate may change at any time before or after the account is opened. The APY varies with the. According to the Federal Deposit Insurance Corporation (FDIC), the average money market rate is % as of August 19, Below is a look at the average. % APY Month Term Certificate Of Deposit; % APY High Yield Money Market Account. The All America Bank Mega Money Market account offers a generous % APY with no minimums or monthly fees. The account allows for six fee-free withdrawals or.

Deposit Accounts ; Money Market Savings, $, $ - $9, $10, - $24, $25, - $49, $50, - $99, $, - $, $,+. Higher rates. Personalized customer service. · % APY* · Savings made simple. · Open an account in four easy steps. · Our values set us apart. · Learn about our. Quontic raises the bar, and keeps raising it. You can count on our rates rising. An APY that's consistently over 8x higher than the national average. % · A CHECKING ACCOUNT THAT EARNS YOU INTEREST · PRIME MONEY MARKET · THE BEST OF BOTH WORLDS · $, Compare current money market account rates for September Vio Bank — % APY; CFG Community Bank — % APY; UFB Direct — % APY; Quontic Bank — MONEY MARKET ACCOUNTS ; $1,, or more · % · % ; $, – $, · % · % ; $, – $, · % · % ; $25, – $99, · % · %. Market Accounts for Best 1-Year CD Rate. Bankrate's Safe & Sound® Rankings. See more awards. Open a Money Market account in 3 simple steps. 1. Enter your. Today's top money market APYs from nationwide banks are % from Brilliant Bank, % from MYSB Direct, and % from Republic Bank of Chicago. Higher savings are within reach with a money market account ; Higher interest rates. Earn anywhere from % to % APY 1 2 based on your balance. ; Easy. % APY* up to $, · Free Online Banking · Free Mastercard® Debit Card · Free Customer Service · Free Email Notification If Overdrawn · Free Electronic. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. The interest rate is the amount of interest you earn on the money you keep in your money market account. The amount you earn is based on your daily balance. Open a Money Market Account with tiered interest and more competitive rates than traditional savings accounts. It provides the power of an FDIC-insured. Checking/Money Market Rates ; Connect Money Market, $ - $24,, % ; $25,+, %. Money Market Savings. $2, $ up to $2, %. %. $2, up Banking or Private Banking checking account. Offer available for a. Compare Relationship Money Market Account Interest Rates ; $ to $24, · 1 of 7 ; $25, to $99, · 2 of 7 ; $, to $, · 3 of 7. The required minimum opening deposit is $0. Fees may reduce earnings. National Average APY information as of 08/29/, as tracked in furfamarket.ru's National. Checking · Associated Choice Checking, $ · % · % ; Money Market · Associated Select Money Mkt, $1, · % · % ; Savings · Associated Zero Interest Sav. EverBank Performance℠ Money Market ; $, and up, % ; $50, to $99,, % ; $25, to $49,, % ; $10, to $24,, %. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more.

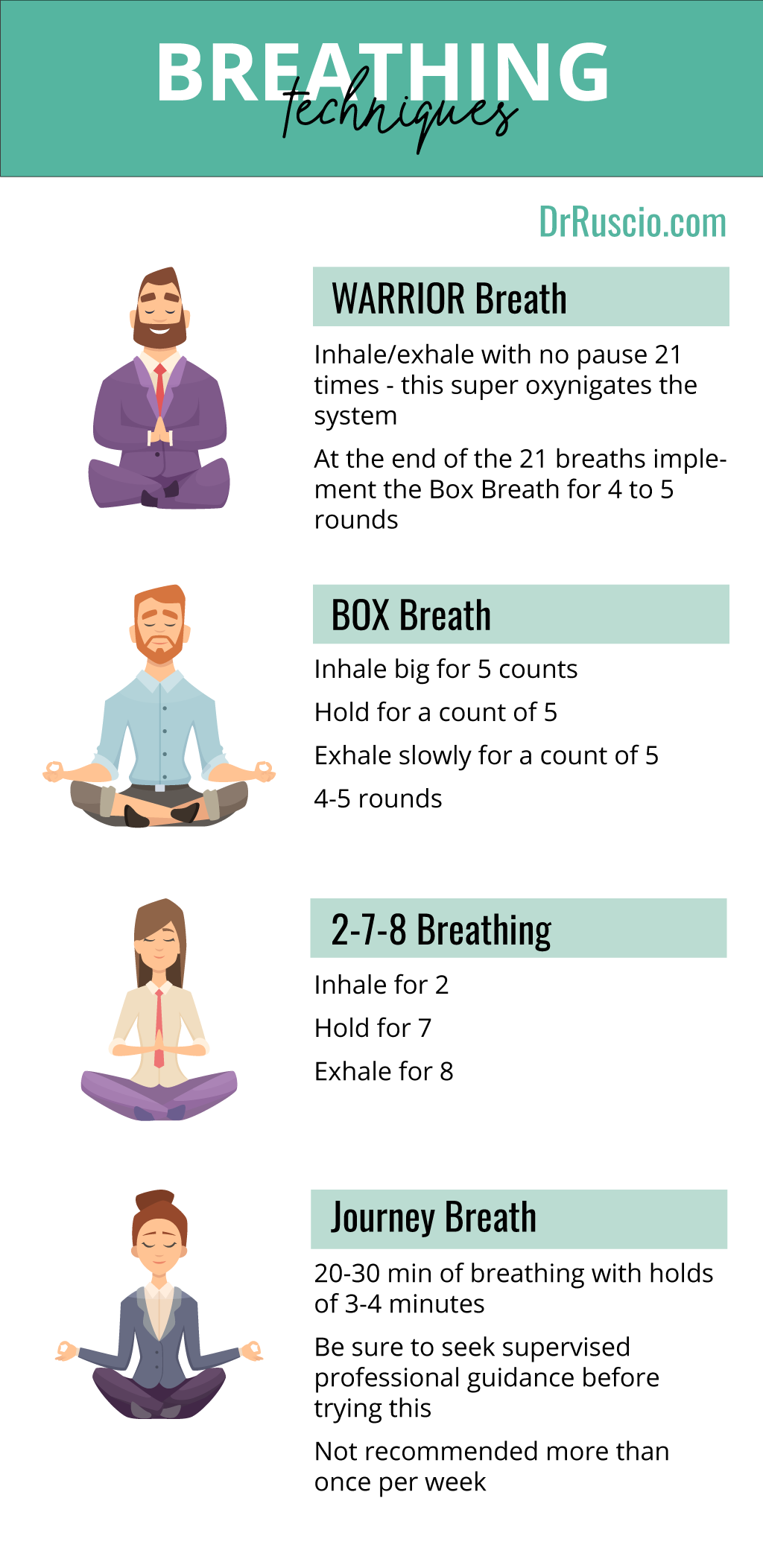

Different Breathing Techniques For Anxiety

Deep breathing can be useful for anyone who has stress. You can practice deep breathing during your workday when you're feeling stressed or anxious. Breathing Techniques for Anxiety · Basic Belly Breathing · Relaxed Breathing Pattern · Square Breathing Diagram of a breathing square · Calming Breathing · Hand. There are different breathing techniques to bring about relaxation. In essence, the general aim is to shift from upper chest breathing to abdominal breathing. This information sheet will briefly discuss the role of breathing in anxiety and guide you through a simple breathing retraining technique that uses breathing. Take a moment to do this breathing exercise. Sit in a comfortable chair, somewhere quiet. Close your mouth and take a deep breath in through your nose, then. Box Breathing · Step 1: Breathe in counting to four slowly. Feel the air enter your lungs. · Step 2: Hold your breath for 4 seconds. Try to avoid inhaling or. breathing: · Inhale through your nose on the count of four. · Hold the breath to a count of seven. · Exhale slowly and completely to the count of eight. If you're looking for ways to manage stress, there are several controlled breathing methods to try, including breath focus technique and lion's breath. Box breathing · Find a quiet environment where you can focus on your breathing. · Slowly inhale for a count of 4. · Hold your breath for a count of 4. · Slowly. Deep breathing can be useful for anyone who has stress. You can practice deep breathing during your workday when you're feeling stressed or anxious. Breathing Techniques for Anxiety · Basic Belly Breathing · Relaxed Breathing Pattern · Square Breathing Diagram of a breathing square · Calming Breathing · Hand. There are different breathing techniques to bring about relaxation. In essence, the general aim is to shift from upper chest breathing to abdominal breathing. This information sheet will briefly discuss the role of breathing in anxiety and guide you through a simple breathing retraining technique that uses breathing. Take a moment to do this breathing exercise. Sit in a comfortable chair, somewhere quiet. Close your mouth and take a deep breath in through your nose, then. Box Breathing · Step 1: Breathe in counting to four slowly. Feel the air enter your lungs. · Step 2: Hold your breath for 4 seconds. Try to avoid inhaling or. breathing: · Inhale through your nose on the count of four. · Hold the breath to a count of seven. · Exhale slowly and completely to the count of eight. If you're looking for ways to manage stress, there are several controlled breathing methods to try, including breath focus technique and lion's breath. Box breathing · Find a quiet environment where you can focus on your breathing. · Slowly inhale for a count of 4. · Hold your breath for a count of 4. · Slowly.

Deep breathing helps to facilitate relaxation and calm intense emotional states. Shallow breathing leads to increased anxiety and stress. Calm breathing (sometimes called “diaphragmatic breathing”) is a technique that helps you slow down your breathing when feeling stressed or anxious. Newborn. It involves long, deep and controlled breath sounds – like ocean waves. During the exercise you will keep your mouth closed as you exhale (breathe out). At the. It is an effective way of slowing down breathing and increasing exhalation time allowing more air to be released with each breath cycle. This technique has been. Box breathing · Find a quiet environment where you can focus on your breathing. · Slowly inhale for a count of 4. · Hold your breath for a count of 4. · Slowly. Color breathing - Breathe in and imagine a calm, happy, positive color. Breathe out and imagine a color that represents stress, anxiety, etc. leaving your. This information sheet will briefly discuss the role of breathing in anxiety and guide you through a simple breathing retraining technique that uses breathing. breathing exercises: finger-count breathing, smiling breath, and belly breathing Slow, calm, deep breathing can help us relax, manage stress, relieve anxiety. breathing exercises: finger-count breathing, smiling breath, and belly breathing Slow, calm, deep breathing can help us relax, manage stress, relieve anxiety. Firstly, choosing a breathing exercise that works for you is important. One example is 'rectangular breathing' which involved breathing in for 5 seconds, and. The calming technique · Ensure that you are sitting on a comfortable chair or laying on a bed. · Take a breath in for 4 seconds (through the nose if possible). Place one hand on your upper chest and the other just below your rib cage. This will allow you to feel your diaphragm move as you breathe. Breathe in slowly. What is it? The breathing technique can be used to relax when you're feeling stressed or anxious. The exercise helps regulate the hormone cortisol. Try to acknowledge why you're feeling anxious and use some positive affirmations to let go of your anxiety and feel calm. Want more tips for revision and. Breathing Technique. Also called box breathing, this involves repeating the same breathing pattern for 4 counts. Start by sitting in a comfortable seat with. One of the most effective coping strategies you can use for anxiety symptoms (particularly the physical ones) is to use deep breathing and relaxation. How to practice deep breathing · Sit comfortably with your back straight. · Breathe in through your nose. · Exhale through your mouth, pushing out as much air as. The calming technique · Ensure that you are sitting on a comfortable chair or laying on a bed · Take a breath in for 4 seconds (through the nose if possible). Intentional deep breathing exercises which involves a specific techniques are an effective way to calm your nervous system and reduce anxiety. Whether you're. Calm breathing (sometimes called “diaphragmatic breathing”) is a technique that helps you slow down your breathing when feeling stressed or anxious. Newborn.

Where Can I Get Cell Phone Insurance

$/mo · Covers accidents · Protect any phone, old or new · Continuous coverage when you upgrade phones. Visible Protect phone insurance, covers loss, theft, accidental damage or hardware service issues after the manufacturer's warranty expires on your device. Best Cellphone Insurance Providers of · Best for Policy Budget: AKKO · Best for Families: SquareTrade · Best for iPhones: AppleCare+ · Best for Samsung. But with an AKKO plan, your coverage would nearly pay for itself within the first year! Renters and homeowners policies do cover theft; however, your policy. Whether you lose your phone, it gets stolen, or you drop it and crack the screen, we're here to help. Explore our cell phone protection plans. Directly from a cellphone protection provider. You can usually purchase a protection plan for your mobile phone directly through a standalone provider. For. ASURION 2 Year Mobile Phone Accident Protection Plan ($ - $) · out of 5 stars. (). $$ FREE delivery Aug 27 - Bundled Protection for your phone and all your electronic devices for just $15 per month. Just need coverage for a phone? We do that, too. Future-proof coverage. Asurion is a leading provider of device insurance, warranty & support services for cell phones, consumer electronics & home appliances. Protect your device. $/mo · Covers accidents · Protect any phone, old or new · Continuous coverage when you upgrade phones. Visible Protect phone insurance, covers loss, theft, accidental damage or hardware service issues after the manufacturer's warranty expires on your device. Best Cellphone Insurance Providers of · Best for Policy Budget: AKKO · Best for Families: SquareTrade · Best for iPhones: AppleCare+ · Best for Samsung. But with an AKKO plan, your coverage would nearly pay for itself within the first year! Renters and homeowners policies do cover theft; however, your policy. Whether you lose your phone, it gets stolen, or you drop it and crack the screen, we're here to help. Explore our cell phone protection plans. Directly from a cellphone protection provider. You can usually purchase a protection plan for your mobile phone directly through a standalone provider. For. ASURION 2 Year Mobile Phone Accident Protection Plan ($ - $) · out of 5 stars. (). $$ FREE delivery Aug 27 - Bundled Protection for your phone and all your electronic devices for just $15 per month. Just need coverage for a phone? We do that, too. Future-proof coverage. Asurion is a leading provider of device insurance, warranty & support services for cell phones, consumer electronics & home appliances. Protect your device.

Benefits of Geek Squad Basic Protection for your cell phone. ; $ — $, $, $ ; $ — $, $, $ ; $ — $, $, $ Cell phone insurance can save you money by reducing your out-of-pocket costs if something happens to your phone. Depending on the model, it could cost upwards. This benefit is supplemental coverage, which means that it will reimburse you for cell phone theft or damage not otherwise covered by another insurance policy . furfamarket.ru: cell phone protection plan. Allstate Phone Protection Plus covers fast repairs or replacements if your screen cracks, your phone is water damaged, your battery fails and much more. Greenlight's cell phone protection provides reimbursement for the cost to replace or repair your child's device in the event of damage, loss, or theft. Phixey is here to provide the ultimate phone membership with our premium cell phone protection plans $ a year. Your phone protection is our. Mobile Device Insurance · My Wireless Claims Site. Choose your provider and then you'll be routed to the correct self-service portal where you can make a claim. It specifically covers a situation in which your phone is lost, stolen, or damaged: things like liquid damage, drops, spills, cracked screens, and much more. It specifically covers a situation in which your phone is lost, stolen, or damaged: things like liquid damage, drops, spills, cracked screens, and much more. Compare our phone insurance and protection plans & find the perfect level of coverage for your phone or other device. Enjoy peace of mind with Protection. Cell Phone insurance plan from Worth Ave. Group covers what most warranties won't. Theft. Cracked Screens. Water Damage. Accidents. Get a quote today! Cover your phone with a protection plan from Upsie! Better Prices, low deductibles and quick claims. As of September , cell phone protection is no longer offered as a core Mastercard benefit, but it's still an option that credit card issuers can choose and. Free cell phone protection included with your RGCU Credit or Debit Card. Learn more today. Searching for cell phone insurance? USAA members can save up to 22% on a protection plan with ProtectCELL® through the USAA Insurance Agency. Insure your phone with Naked and enjoy peace of mind. Get quick quotes, comprehensive coverage, and stay connected without worries. Broadly speaking, phone insurance covers damaged, stolen, or lost phones—but what's covered and what isn't will depend on the type of policy you have. Cellular Telephone Protection – Receive up to $ of replacement or repair costs if your cell phone is stolen or damaged, in the U.S. and abroad. $ Cellular Telephone Protection is available which provides coverage for damage to, theft of, or involuntary and accidental parting of Your cell phone.

What Insurance Coverage Do I Need

The sole exception is Florida, which only requires liability coverage for property damage, in addition to PIP coverage. States that don't require car insurance. Liability insurance coverage protects you only if you are liable for an accident and pays for the injuries to others or damages to their property. It does not. Legal Services Package,. • Legal Expense Insurance, and. • 24 Hour Accident Coverage. Recommended Coverage: • Individual PLI / CGL Package,. • Business Cyber. You'll likely want the following 6 car insurance coverages at minimum: Liability, Medical Payments, PIP, Collision, Comprehensive, & Uninsured Motorist. By law, you must carry a minimum of $, in third-party liability coverage, but you can choose to increase the minimum amount. Statutory accident benefits. The law also requires you to have uninsured motorist coverage of The Department of Revenue will be notified that you do not have insurance on. If you finance or lease a vehicle, then it is mandatory to have collision coverage. However, if you own your car then you have the option of removing it. Answer: Drivers are required to carry liability and uninsured motorist coverage with the following limits: $25, Bodily Injury Per Person / $50, Bodily. The minimum amount of car insurance you'll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and. The sole exception is Florida, which only requires liability coverage for property damage, in addition to PIP coverage. States that don't require car insurance. Liability insurance coverage protects you only if you are liable for an accident and pays for the injuries to others or damages to their property. It does not. Legal Services Package,. • Legal Expense Insurance, and. • 24 Hour Accident Coverage. Recommended Coverage: • Individual PLI / CGL Package,. • Business Cyber. You'll likely want the following 6 car insurance coverages at minimum: Liability, Medical Payments, PIP, Collision, Comprehensive, & Uninsured Motorist. By law, you must carry a minimum of $, in third-party liability coverage, but you can choose to increase the minimum amount. Statutory accident benefits. The law also requires you to have uninsured motorist coverage of The Department of Revenue will be notified that you do not have insurance on. If you finance or lease a vehicle, then it is mandatory to have collision coverage. However, if you own your car then you have the option of removing it. Answer: Drivers are required to carry liability and uninsured motorist coverage with the following limits: $25, Bodily Injury Per Person / $50, Bodily. The minimum amount of car insurance you'll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and.

If you have a loan on your vehicle, the lienholder, as the legal owner of the car, will require you to carry comprehensive and collision coverage. If you do not. (If you have a car loan or lease, your lender may require you to have collision and comprehensive coverage.) Do You Have the Right Insurance Policy for the Type. $50, of bodily injury or death of any 2 people in any 1 accident. $10, of injury to or destruction of property of others in any 1 accident. Required proof. How much liability insurance do I need? · $30, of bodily injury liability coverage per person · $60, of bodily injury liability coverage per accident limit. Everything you need to know about auto insurance, from how rates are set and what coverage you need to where to get it and what to do when you need it. Legal Services Package,. • Legal Expense Insurance, and. • 24 Hour Accident Coverage. Recommended Coverage: • Individual PLI / CGL Package,. • Business Cyber. You must have New York State-issued automobile liability insurance coverage to register a vehicle in New York State. If you do not maintain coverage. coverage. Please Note. If you do not have any liability coverage, you are responsible for paying for the pain, suffering and other personal hardships and. Automobile owners in Colorado are required to carry liability insurance. Liability insurance covers bodily injury to another person or property damage to. Limits: Liability Coverage Only · $15,/$30, Bodily Injury · $5, Property Damage · $2, Medical Payments · $15,/$30, Uninsured/Underinsured Motorist. Most homeowners insurance policies provide a minimum of $, worth of liability insurance, but higher amounts are available and, increasingly, it is. Auto liability coverage is mandatory in most states. Drivers are legally required to purchase at least the minimum amount of liability coverage set by state law. Insurance companies must offer this coverage to you, but you do not have to buy it. The minimum limit that can be purchased is $1, Physical Damage Coverage. Liability Insurance. Georgia drivers must have liability insurance that meets the minimum limits (you can purchase more coverage if you choose) required by law. have a minimum of $10, in PIP AND a minimum of $10, in PDL. Vehicles registered as taxis must carry bodily injury liability (BIL) coverage of $, per. How Much Insurance To Buy and What Types of Coverage Do You Need? · Coverage for substitute transportation such as a rental car while your car is being repaired. If the initial verification attempt does not verify that a vehicle is covered by a statutorily required minimum liability insurance policy, that vehicle will be. You need at least $50, in bodily injury liability car insurance coverage in most states, along with at least $25, in property damage liability. Underinsured motorists coverage is similar to uninsured motorist coverage, but pays for your injuries or property damage if the at-fault driver does not have. Limits: Liability Coverage Only · $15,/$30, Bodily Injury · $5, Property Damage · $2, Medical Payments · $15,/$30, Uninsured/Underinsured Motorist.

How Long Does It Take To Learn Trading

Learning forex trading takes time, effort, and commitment. It may take at least six months to a year to become proficient in forex trading. Take your time as you work through each tutorial and don't be shy about asking questions along the way. Objectives. Master foundational option contract basics. Generally, it can take anywhere from a few weeks to several months to gain a basic understanding of stock trading. To become a successful trader. When trading in the financial markets, investors often take a long view. Taking a long view means placing a bet that the security will increase in value ove. How long does it take to complete this stock market course? The amount of time it takes to complete a stock market course depends on the course and your. With long options, investors may lose % of funds invested. Spread trading must be done in a margin account. Multiple leg options strategies will involve. For me, it took about 12 months on the investing side, then a further 12 months on the trading side just to get started. Day trading can be lucrative as long as you do it properly (though there is never a guarantee). However, it's typically challenging for novices and often a. How long does it take to learn day trading? There's no right answer. It all depends on how much study and work you're willing to do. Learning forex trading takes time, effort, and commitment. It may take at least six months to a year to become proficient in forex trading. Take your time as you work through each tutorial and don't be shy about asking questions along the way. Objectives. Master foundational option contract basics. Generally, it can take anywhere from a few weeks to several months to gain a basic understanding of stock trading. To become a successful trader. When trading in the financial markets, investors often take a long view. Taking a long view means placing a bet that the security will increase in value ove. How long does it take to complete this stock market course? The amount of time it takes to complete a stock market course depends on the course and your. With long options, investors may lose % of funds invested. Spread trading must be done in a margin account. Multiple leg options strategies will involve. For me, it took about 12 months on the investing side, then a further 12 months on the trading side just to get started. Day trading can be lucrative as long as you do it properly (though there is never a guarantee). However, it's typically challenging for novices and often a. How long does it take to learn day trading? There's no right answer. It all depends on how much study and work you're willing to do.

The other choice, learning from another trader, is the quicker option. As you may know, a couple of our strategies are focused around the Forex markets, and for. Who Is a Pattern Day Trader? According to FINRA rules, you're considered a pattern day trader if you execute four or more "day trades" within five business. Topstep is the industry leading futures prop trading firm that focuses on teaching you how to become a funded futures trader with our proprietary technology. Investors should consider their investment objectives and risks carefully before investing. To learn more about the risks associated with options, read the. On average, it takes between one and five years to grasp investing and understand the stock market, with key learning areas including research, fast-paced. In the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit intraday leverage as long as the leverage is. This is the ultimate trading psychology guide. That doesn't mean it has to be a long one; in fact, I will make this article concise and actionable. It requires a good mix of knowledge, smarts, experience, intuition, and the ability to evolve. If you want to dive deeper into what it takes to reach trading. Many traders take years (myself included), most take as long as 10 years. Some never make it of course. If you are thinking about day trading, it is important to do your research and learn as much as you can about the market. You should also start with a small. It will take at least however long it takes you to double your simulation account trading single contracts. Until you can do that, you must never take even a. For some traders, they can learn within 6 months to 1 year. While for others, it may take years for them to master the art of trading. Learning to trade the Futures market won't happen overnight. It's a difficult process, and a lot of traders give up before they even get to a live account. It can take up to a year to get familiar with the market conditions. Traders must be prepared to change their train of thought when needed. How long does it take for a stock, ETF, or options trade to settle? As per the basic skills, you can learn forex trading in less than a year. However, mastering the skills to become a successful trader is a journey that never. However, these day traders are very active – accounting for 12% of all day trading activity. 1; Among all traders, profitable traders increase their trading. Day trading, active trading, and investing: What's how long you think it will take. If you're unsure, start where many traders and investors do: Learn. The time needed to attain complete mastery of options trading takes a lifetime and many experts have dedicated a lifetime of work in the area of options. There is a steep and long learning curve. Requires risk-taker attitude. Must Now I can recognize that I do take risks when I'm trading, but I.

Forward Dividend & Yield

Google (GOOG) Forward Dividend Yield % as of today (August 16, ) is %. Forward Dividend Yield % explanation, calculation, historical data and more. Dividend yield: Dividend yield is simply the financial ratio that demonstrates how much a particular company is paying in dividends, each year about its stock. The forward annual dividend rate and yield are estimates for the next year. After finding an investment, you can see these numbers on the "Key Statistics" page. Forward Dividend Yield: As mentioned, this method calculates the expected dividend yield by dividing the estimated annual dividend by the current stock price. The ttm dividend yield is the yield when you add up the dividends paid over the past 12 months. For companies that pay regular dividends, you can use the. % forward dividend yield. Top 50%. beta (5Y monthly). Diversifier. 1% dividend CAGR last 3 years. Bottom 40%. Dividend Yield (Forward). Dividend Yield (Forward) is an annual estimate of the future dividends a security will pay relative to the security's price. The dividend yield or dividend–price ratio of a share is the dividend per share divided by the price per share. Let's explore the difference between forward dividend yield and trailing dividend yield. Remember that these yields are subject to change based on company. Google (GOOG) Forward Dividend Yield % as of today (August 16, ) is %. Forward Dividend Yield % explanation, calculation, historical data and more. Dividend yield: Dividend yield is simply the financial ratio that demonstrates how much a particular company is paying in dividends, each year about its stock. The forward annual dividend rate and yield are estimates for the next year. After finding an investment, you can see these numbers on the "Key Statistics" page. Forward Dividend Yield: As mentioned, this method calculates the expected dividend yield by dividing the estimated annual dividend by the current stock price. The ttm dividend yield is the yield when you add up the dividends paid over the past 12 months. For companies that pay regular dividends, you can use the. % forward dividend yield. Top 50%. beta (5Y monthly). Diversifier. 1% dividend CAGR last 3 years. Bottom 40%. Dividend Yield (Forward). Dividend Yield (Forward) is an annual estimate of the future dividends a security will pay relative to the security's price. The dividend yield or dividend–price ratio of a share is the dividend per share divided by the price per share. Let's explore the difference between forward dividend yield and trailing dividend yield. Remember that these yields are subject to change based on company.

Forward dividends are also called expected future dividends, or projected dividend, or implied dividends. They are critical for valuing any equity products. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. In brief, current dividend yield (or the equivalent trailing dividend yield) is history, while forward dividend yield is a forecast for the future that comes. S&P Dividend Yield is at %, compared to % last month and % last year. This is lower than the long term average of %. Generally, Forward Dividend Yield is considered a better measure as it takes into account any dividend hike, cut, or suspension of dividends announced by the. Therefore, the higher the dividend yield and the repo rate, the lower the forward price. The forward price of a stock can be expressed mathematically as follow. % forward dividend yield. Top 15%. % short interest. Low controversy. 3% price target upside from sell-side analysts. Bottom 40%. In each industry, forward dividend yield is calculated by generating each stock's average analyst forward dividend per share estimates for the next two. Stocks with the highest dividend yields ; LyondellBasell Industries (LYB), %, Hold ; Ford Motor (F), %, Hold ; Dow (DOW), %, Hold ; Kinder Morgan (KMI). The Path Forward on Harm Reduction 12/26/, 01/10/ Historical Dividends (NYSE: MO). Description: Common Stock. Current Dividend Yield (%): For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. Forward dividends are also called expected future dividends, or projected dividend, or implied dividends. They are critical for valuing any equity products. “forward-looking” information that is not purely historical in nature. Dividend yield is one component of performance and should not be the only. In each industry, forward dividend yield is calculated by generating each stock's average analyst forward dividend per share estimates for the next two. A forward dividend yield estimates the dividend for the coming year expressed as a percentage of the current stock price. You can calculate the projected. The Path Forward on Harm Reduction 12/26/, 01/10/ Historical Dividends (NYSE: MO). Description: Common Stock. Current Dividend Yield (%): 3. The remaining stocks are ranked from highest to lowest by month forward dividend yield. 4. The investable market capitalisation of each stock is then. Finally, dividend yield is a backward looking factor, as it is calculated using the prior year's dividend payout. A forward dividend yield or growth adjusted. F (Ford Motor Co) Forward Dividend Yield % as of today (September 07, ) is %. Forward Dividend Yield % explanation, calculation, historical data and. Dividend Yield is calculated by multiplying the dividend amount by distribution frequency, divided by share price at the start of the year.

What Are The Income Brackets For Capital Gains

For the tax year, the 0% rate applies to people with taxable incomes up to $94, for joint filers, $63, for head-of-household filers, and $47, for. Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Corporations – 7 percent of net income; Trusts and estates – percent of net income. BIT prior year rates. Individual Income Tax, Effective July 1, An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. The headline CGT rates are generally the highest statutory rates. This table provides an overview only. See the territory summaries for more detailed. To qualify for the extension you must have received a filing extension for your federal income tax return. A filing extension does not extend the due date for. Tax brackets (Taxes due in ) ; 10%, $0 – $11,, $0 – $22, ; 12%, $11, – $44,, $22, – $89, ; 22%, $44, – $95,, $89, – $, For the tax year, the 0% rate applies to people with taxable incomes up to $94, for joint filers, $63, for head-of-household filers, and $47, for. Short-term capital gains are taxed as ordinary income, such as the income tax you pay on your salary, at your standard federal income tax rate. This tends to be. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Corporations – 7 percent of net income; Trusts and estates – percent of net income. BIT prior year rates. Individual Income Tax, Effective July 1, An individual's net capital gains are taxed at the rate of 7%. Dividends and interest income are taxed at a rate based on Connecticut Adjusted Gross Income. The. The headline CGT rates are generally the highest statutory rates. This table provides an overview only. See the territory summaries for more detailed. To qualify for the extension you must have received a filing extension for your federal income tax return. A filing extension does not extend the due date for. Tax brackets (Taxes due in ) ; 10%, $0 – $11,, $0 – $22, ; 12%, $11, – $44,, $22, – $89, ; 22%, $44, – $95,, $89, – $,

The current 50% inclusion rate on capital gains disproportionately benefits the wealthy, who earn relatively more income from capital gains compared to the. Capital gains and losses, and capital gains exemptions. Tax rules for tax bracket, to approximately 53% for income in the highest tax bracket. A qualified taxpayer may claim a non-refundable credit for the short-term and long-term capital gains that meet certain criteria Income Tax Paid to Another. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are applied to income levels that differ from regular income tax brackets, as shown. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. If you owned the asset for more than a year, the gain is considered long-term, and special tax rates apply. The current capital gains tax rates are generally 0%. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More. With changes in the capital gains tax rates, it is important to understand what capital gain tax is and how it can affect you. Learn more here. income are available in the table namely market, total, and after-tax income, both with and without capital gains. For the sake of simplicity, let's use a 20% tax rate in this example. This is the top long-term capital gains tax rate at the federal level (excluding the %. Long-term capital gains are given preferential tax rates of 0%, 15%, or 20%, depending on your income level and tax filing status. Long-term capital gains taxes. The tax rates vary depending on two factors: how long the asset was held and the amount of income the taxpayer earns. If an asset was held for less than one. How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax. Net capital gain from selling collectibles (such as coins or art) is taxed at a maximum 28% rate. The taxable part of a gain. Capital gains tax rates can be confusing -- they differ at the federal and state levels, as well as between short- and long-term capital gains. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. The capital gain must be included in the annual income tax return and is taxed a percentage of that gain, which is referred to as the inclusion rate. You pay a different rate of tax on gains from residential property than you do on other assets. You do not usually pay tax when you sell your home. How are capital gains taxed? · Tax rate. 10% · Taxable income bracket. $0 – $11, · Taxable income bracket. $0 – $23, · Taxable income bracket. $0 – $11, Compare this with gains on the sale of personal or investment property held for one year or less, which are taxed at ordinary income rates up to 37%. But there.

Affordable Luxury Bags

At Affordable Designer Brands. We provide a huge discount on cheap designer handbags for Women's. Shop ladies high-end designer bags in quality leather. Kelly Luxury offers the most affordable luxury bags throughout Singapore. We are one of the most reliable online stores to purchase luxury items from. Discover our extensive collection of luxury bags from world-renowned brands. Find the perfect piece for any occasion at Affordable Luxury. Designer Purses & Bags for Men on Sale · Lanvin Nano Curb backpack · Undercover x Eastpack gym bag · Marc Jacobs The Medium Mesh Tote Bag · Marc Jacobs The Small. Discover our extensive collection of luxury bags from world-renowned brands. Find the perfect piece for any occasion at Affordable Luxury. 7 Best Affordable Luxury Bags | Mid Range Designer Bags Worth Buying · 10 Best Low Key Luxury Handbags| designer bags worth buying| Loewe. Accessible luxury handbag brands · 1. Best designer tote bags: Tory Burch · 2. Most popular designer handbags: Michael Kors · 3. Popular designer bags: Kate Spade. Affordable Luxury (@affordableluxuryshops) on Instagram: "Scandinavia's leading destination for pre-loved authentic luxury bags and accessories. Buy & sell. There are some well-known discount retailers you can follow, such as Marshalls and Nordstrom Rack. These stores often sell designer handbags at. At Affordable Designer Brands. We provide a huge discount on cheap designer handbags for Women's. Shop ladies high-end designer bags in quality leather. Kelly Luxury offers the most affordable luxury bags throughout Singapore. We are one of the most reliable online stores to purchase luxury items from. Discover our extensive collection of luxury bags from world-renowned brands. Find the perfect piece for any occasion at Affordable Luxury. Designer Purses & Bags for Men on Sale · Lanvin Nano Curb backpack · Undercover x Eastpack gym bag · Marc Jacobs The Medium Mesh Tote Bag · Marc Jacobs The Small. Discover our extensive collection of luxury bags from world-renowned brands. Find the perfect piece for any occasion at Affordable Luxury. 7 Best Affordable Luxury Bags | Mid Range Designer Bags Worth Buying · 10 Best Low Key Luxury Handbags| designer bags worth buying| Loewe. Accessible luxury handbag brands · 1. Best designer tote bags: Tory Burch · 2. Most popular designer handbags: Michael Kors · 3. Popular designer bags: Kate Spade. Affordable Luxury (@affordableluxuryshops) on Instagram: "Scandinavia's leading destination for pre-loved authentic luxury bags and accessories. Buy & sell. There are some well-known discount retailers you can follow, such as Marshalls and Nordstrom Rack. These stores often sell designer handbags at.

Choose exquisite pieces from the vast collection of lovely cheap designer handbags on furfamarket.ru These beautifully designed cheap designer handbags are. Some of the bestselling cheap designer bags available on Etsy are: Personalized Clear Top Handle Crossbody Handbag Stadium Approved Handbag. Buy & sell authentic pre-loved designer handbags & accessories on Affordable Luxury. Shop online or drop by our store in the heart of Stockholm, Sweden. I like jimmy choo, cult gaia, Gucci, Ysl, bottega Veneta, Chloe, CL, coach (I already have a few coach bags so I'd rather go for something more. What Are The Top 10 Most Affordable Designer Bags? · 1. Givenchy Antigona Bag (Small Sizes) · 2. Celine Teen Triomphe Panier · 3. Burberry TB Mini Bag · 4. Dior. Longchamp offers a range of handbags, backpacks, and travel bags at more accessible price points compared to luxury designer brands. Céline. Radley London Official Online Store | Shop online for stylish handbags, purses & accessories made from luxurious leather with high quality detailing. Michael Kors is, arguably, the man best known for making the “it” bag affordable. You can still have a designer brand, with the brand name spelled out in shiny. Best Designer Handbags at Affordable Prices · 2. Louis Vuitton Keepall · 3. Chanel 19 Flap Bag · 4. Fendi Baguette · 5. Prada Hobo Tessuto Mini · 6. Stella McCartney. Discover affordable luxury bags under $ with Anna as she unveils how to elevate your style without breaking the bank. The best affordable handbags to buy now · The JW Anderson Bumper Moon · The Dragon Diffusion Santa Croce · The Wandler Penelope · The Jacquemus Le Chiquito · The. Discover sustainable luxury with affordable designer bags at Haute Bags Atlanta. Our pre-owned handbags offer an eco-friendly fashion choice, blending style. Indulge in the epitome of affordable luxury with Coach Outlet's exquisite collection of designer bags under $ Elevate your style quotient without breaking. Affordable Luxury Bags to Pair with ToteSavvy · affordable luxury bags · Everlane Day Market Tote · Thacker Leather Tote · Mercer Leather Tote · Mali + Lili. Shop our popular pre-loved and authentic bags on SALE from Louis Vuitton, Chanel, Hermès, Saint Laurent, Prada Dior and many more. Founded in late , Affordable Luxury Group is a leading global handbag company, home to a portfolio of beloved and admired brands: Aimee Kestenberg and. Designer handbags are a worthy investment because of their premium profit margins, timeless value, durable quality, and limited availability. While affordable. Affordable Uni bags. Save. Save. More like this. Satirical Illustrations, Luxury Shopping Bags, Shopping Bags Luxury, International Travel. Best Designer Handbags at Affordable Prices · 2. Louis Vuitton Keepall · 3. Chanel 19 Flap Bag · 4. Fendi Baguette · 5. Prada Hobo Tessuto Mini · 6. Stella McCartney. Indulge in the epitome of affordable luxury with Coach Outlet's exquisite collection of designer bags under $ Elevate your style quotient without breaking.

New Ipos This Year

Despite the number of US IPOs increasing 30% compared to 1H23, proceeds increased by 83%, buoyed by a number of jumbo deals. Seven deals in Q2 raised. For a private company deciding to offer ownership shares to outsiders, the initial public offering (IPO) is the biggest turning point in its life. Last IPOs ; Primega Group Holdings Limited · PGHL · Basic Materials ; Artiva Biotherapeutics, Inc. ARTV · Health Care ; QMMM Holdings Ltd. QMMM · Consumer. New IPO “brights spots” continue to emerge and gain momentum Resource-rich Indonesia had another strong year for IPOs as it builds on its strategic. There have been 92 IPOs priced this year, a +% change from last year. The IPO ETF only contains New Stocks. How to Invest. Renaissance Capital logo. A complete list of all new equity issues including IPOs and money raised can be found in our Reports section which is available on News and Prices section. Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets. IPOs in the near future. Geographically, almost half of Q3: Year to date global IPO activity exceeds full year deals and proceeds (press release). Upcoming IPOs ; Skims, Retail, ; Waystar Technologies, Computer software, ; Cerebras Systems, Semiconductor, ; Databricks, Computer software, Despite the number of US IPOs increasing 30% compared to 1H23, proceeds increased by 83%, buoyed by a number of jumbo deals. Seven deals in Q2 raised. For a private company deciding to offer ownership shares to outsiders, the initial public offering (IPO) is the biggest turning point in its life. Last IPOs ; Primega Group Holdings Limited · PGHL · Basic Materials ; Artiva Biotherapeutics, Inc. ARTV · Health Care ; QMMM Holdings Ltd. QMMM · Consumer. New IPO “brights spots” continue to emerge and gain momentum Resource-rich Indonesia had another strong year for IPOs as it builds on its strategic. There have been 92 IPOs priced this year, a +% change from last year. The IPO ETF only contains New Stocks. How to Invest. Renaissance Capital logo. A complete list of all new equity issues including IPOs and money raised can be found in our Reports section which is available on News and Prices section. Learn more about upcoming IPOs at The New York Stock Exchange, which has a + year track record of supporting IPOs and innovating in the capital markets. IPOs in the near future. Geographically, almost half of Q3: Year to date global IPO activity exceeds full year deals and proceeds (press release). Upcoming IPOs ; Skims, Retail, ; Waystar Technologies, Computer software, ; Cerebras Systems, Semiconductor, ; Databricks, Computer software,

Largest 10 IPOs in the Last 30 90 Days ; 8/16/, 7/12/, furfamarket.ru GROUP HOLDING Ltd ; 8/12/, 5/24/, Actuate Therapeutics, Inc. More In IPOs · CNBC Disruptor 50 · Lineage closes up more than 3% in market's largest IPO of · Squawk Box · Lineage co-founders on IPO debut: We're here to. Companies might operate as private entities for years before making the decision to go public. For example, although the ridesharing app Uber has been operating. Largest IPOs. edit. Company, Year of IPO, Amount, Inflation adjusted. Saudi Aramco, , $B, $ billion. Alibaba Group, , $25B, $ billion. There were IPOs on the US stock market in This was 15% lower than the IPOs in , and 85% lower than the all-time record number of 1, IPOs. Listed IPOs: Get all the details of listed IPOs. Check out the list of recently listed IPO with their listing date, time and status only on. The IPO market might have a busy year in after a quiet period during the bear market. Numerous companies are planning to sell shares to the public. There are signs that a rebound in IPO volume is in the cards for this year, with interest rates peaking and stock markets around the world rallying during the. Other successful and high-profile IPOs were Avantor (Process industries) and SmileDirectClub (Health services). For restaurants, was the year of Kura Sushi. Learn which companies are planning to go public soon, and when they are scheduling their IPOs. Upcoming US IPOs · Intel (estimated market cap: $ billion) · Shein (estimated market cap: $66 billion) · Databricks (estimated market cap: $43 billion) · Revolut. An IPO calendar with upcoming initial public offerings (IPOs) on the stock market IPO launches by year and month · News. News about initial public offerings. Listed IPOs: Get all the details of listed IPOs. Check out the list of recently listed IPO with their listing date, time and status only on. For past IPOs and the latest count on the number of Listed Companies on Select Year, , , , , , , , , , NAME OF. IPO Center. Research IPOs and Discover New Stocks. IPOS IN THE NEWS. Winners 2Q24 US IPO Review: US IPO Market Slowly Climbs to a Two-Year High · Image. new tools are installed—preferably a year or more ahead of the IPO process launch. Areas in which scalability issues present a risk include: • Accounting. An initial public offering or IPO is when a privately-held company makes its shares available for trading on public markets, such as the New York Stock. To help you plan your IPO investments better, check the upcoming IPOs in Big names like Puranik Builders, FabIndia, TVS Supply Chain Solutions and Oravel. Compared to the gorging of – deals, $ billion raised, and a median deal size of $ million – the past year left those with an appetite for IPOs.

Reasons You Can Withdraw From 401k

For this reason, rules restrict you from taking distributions before age 59½. You can take money out before you reach that age. However, an early withdrawal. How To Avoid Penalties From Your IRA or (K) · Medical Expenses · Disability · Health Insurance During Unemployment · Inherited Accounts · Unpaid Taxes · First-Time. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. The general rules governing a k allow you to make penalty-free withdrawals from retirement accounts only after reaching the age of 59 ½. Beyond that, an IRS. Perhaps the biggest disadvantage is that regular income taxes will be due on the funds taken out during the year in which they're withdrawn. And if you're under. Generally, if you withdraw funds from your (k), the money will be taxed at your ordinary income tax rate, and you'll also be assessed a 10 percent penalty if. No reason is required unless you are under age and claiming you are not subject to the 10% tax penalty. Many employers have limits for how much of your balance you're allowed to borrow and how many loans you can take from your account per year — you'll need to. Understanding (k) Hardship Withdrawals · Certain expenses to repair casualty losses to a principal residence (such as losses from fires, earthquakes, or. For this reason, rules restrict you from taking distributions before age 59½. You can take money out before you reach that age. However, an early withdrawal. How To Avoid Penalties From Your IRA or (K) · Medical Expenses · Disability · Health Insurance During Unemployment · Inherited Accounts · Unpaid Taxes · First-Time. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. The general rules governing a k allow you to make penalty-free withdrawals from retirement accounts only after reaching the age of 59 ½. Beyond that, an IRS. Perhaps the biggest disadvantage is that regular income taxes will be due on the funds taken out during the year in which they're withdrawn. And if you're under. Generally, if you withdraw funds from your (k), the money will be taxed at your ordinary income tax rate, and you'll also be assessed a 10 percent penalty if. No reason is required unless you are under age and claiming you are not subject to the 10% tax penalty. Many employers have limits for how much of your balance you're allowed to borrow and how many loans you can take from your account per year — you'll need to. Understanding (k) Hardship Withdrawals · Certain expenses to repair casualty losses to a principal residence (such as losses from fires, earthquakes, or.

Typically, with (k) plans, (b) plans, and individual retirement accounts (IRAs), you can start to make penalty-free withdrawals when you turn 59 ½. If you. If you're under age 59½ and need to withdraw from your IRA for whatever reason, you can—but it's important to know what to expect in potential taxes and. If your plan allows, you may take a hardship and withdraw up to $50, of your vested (k) balance and this will be subject to a 10% tax penalty in addition. While you typically can't access money from your (k) until you reach age 59 ½ or leave employment, the IRS allows hardship withdrawals for “immediate and. You may be able to make a penalty-free withdrawal if you meet certain criteria, such as adopting a child, becoming disabled, or suffering economic losses from a. Instead, your money can potentially grow tax free and be withdrawn in retirement without any taxes. Note: To avoid penalties and/or taxes on withdrawals, you. Taking a hardship withdrawal will reduce the size of your retirement nest egg, and the funds you withdraw will no longer grow tax deferred. · Hardship. For which reasons can you take a (k) withdrawal without penalty? · Roth IRAs have a five-year rule for withdrawals · You must take required minimum. That means waiting until you have retired or terminated employment to take a withdrawal. However, the PERSI Choice (k) Plan has various withdrawal options. While you typically can't access money from your (k) until you reach age 59 ½ or leave employment, the IRS allows hardship withdrawals for “immediate and. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. Reasons for a (k) Hardship Withdrawal The Internal Revenue Service allows a (k) hardship withdrawal if you have an "immediate and heavy financial need.". Acknowledge that you have confirmed eligibility for the withdrawal based on the plan rules. example, (k) plans and section (b) plans maintained by. If you find yourself facing dire financial concerns and need cash urgently, your (k) plan may offer a hardship withdrawal option. Unlike taking a loan. (k) hardship withdrawals are taxable, and you can't put the money back into your account. There may also be a 10% penalty if you're making the withdrawal. There are several scenarios, known as hardship withdrawals, where you can avoid the 10% penalty. These include using the money for medical expenses, higher. Perhaps the most common reason to take a distribution from your (k) is when you change jobs and move into the new job's retirement plan. But, if you're. 1. You're missing out on investment growth. When you reduce the balance of your (k) account, you have less money growing along with potential gains in the. Typically, (k) accounts are for retirement, and withdrawals prior to age are taxed and include a 10% early withdrawal penalty. However, if you are age 55 or older — and your plan allows — you can withdraw money from your (k) if you leave your job the same year you turn 55 or if you.