furfamarket.ru

Market

What Is A Business Balance Sheet

A balance sheet will provide you a quick snapshot of your business's finances - typically at a quarter- or year-end—and provide insights into how much cash. This sample balance sheet from Accounting Coach shows the line items reported, the layout of the document and how it differs from an income statement. A balance sheet is one of the three primary financial statements used to monitor the health of your business, along with your cash flow statement and the income. A balance sheet is a financial "snapshot" of your business at a given date in time. It includes your assets and liabilities and tells you your business's. The balance sheet includes three components: assets, liabilities, and equity. It's divided into two sides — assets are on the left side, and total liabilities. Businesses use a balance sheet to monitor the company's financial health and make informed decisions about resource allocation, investment opportunities, and. The balance sheet provides information on a company's resources (assets) and its sources of capital (equity and liabilities/debt). A company's balance sheet is a snapshot in time. You can learn a lot about a business's health by looking at its balance sheet and calculating some ratios. A balance sheet lists your business's assets (what it owns), liabilities (what it owes), and the amount left over for owners' equity. Owners' equity is the. A balance sheet will provide you a quick snapshot of your business's finances - typically at a quarter- or year-end—and provide insights into how much cash. This sample balance sheet from Accounting Coach shows the line items reported, the layout of the document and how it differs from an income statement. A balance sheet is one of the three primary financial statements used to monitor the health of your business, along with your cash flow statement and the income. A balance sheet is a financial "snapshot" of your business at a given date in time. It includes your assets and liabilities and tells you your business's. The balance sheet includes three components: assets, liabilities, and equity. It's divided into two sides — assets are on the left side, and total liabilities. Businesses use a balance sheet to monitor the company's financial health and make informed decisions about resource allocation, investment opportunities, and. The balance sheet provides information on a company's resources (assets) and its sources of capital (equity and liabilities/debt). A company's balance sheet is a snapshot in time. You can learn a lot about a business's health by looking at its balance sheet and calculating some ratios. A balance sheet lists your business's assets (what it owns), liabilities (what it owes), and the amount left over for owners' equity. Owners' equity is the.

A balance sheet is a document that outlines a company's finances such as cash flow and debts. Accountants and other finance professionals typically enter and. It's used to state a business's assets, liabilities, and shareholder's equity at a given point in time, offering a snapshot of everything your business owns and. As a business owner, you can use the balance sheet to review and manage the relationship between the money inside your company and the money you owe other. The balance sheet is simply a statement of what a company owns (its assets), what it owes (its liabilities) and its book value, or net worth (also called. A balance sheet is a key financial statement that represents a company's financial status at any given point in time, capturing the company's assets. A balance sheet is a financial report that summarises the financial state of a business at a point in time. The statement provides you with an overall indication of a businesses position and can provide quick insights with regards to working capital and liquidity. The balance sheet displays the company's total assets and how the assets are financed, either through either debt or equity. A balance sheet is a snapshot of what a business owns (assets) and owes (liabilities) at a specific point in time. The balance sheet shows the company's financial position, what it owns (assets) and what it owes (liabilities and net worth). This financial statement details your assets, liabilities and equity, as of a particular date. Although a balance sheet can coincide with any date, it is. A company's balance sheet, also known as a "statement of financial position," reveals the firm's assets, liabilities, and owners' equity (net worth) at a. A company's balance sheet is a snapshot in time. You can learn a lot about a business's health by looking at its balance sheet and calculating some ratios. The balance sheet is a snapshot of your business financials. It includes assets, and liabilities and net worth. The balance sheet provides a snapshot of the business at a specific point in time, which is whenever the balance sheet is generated, for a month, quarter, or. Balance sheets help keep track of assets and liabilities, providing a financial snapshot of what your business owns and owes at one point in time and thus. A net worth statement or balance sheet is designed to provide a picture of the financial soundness of your business at a specific point in time. A small business balance sheet consists of a company's assets, liabilities, and an overview of owner equity. You put a lot of effort into making sure your. A balance sheet is often described as a "snapshot of a company's financial condition". It is the summary of each and every financial statement of an. A balance sheet is a report that shows a company's financial health at a specific point in time. It reports on three distinct factors: assets, liabilities and.

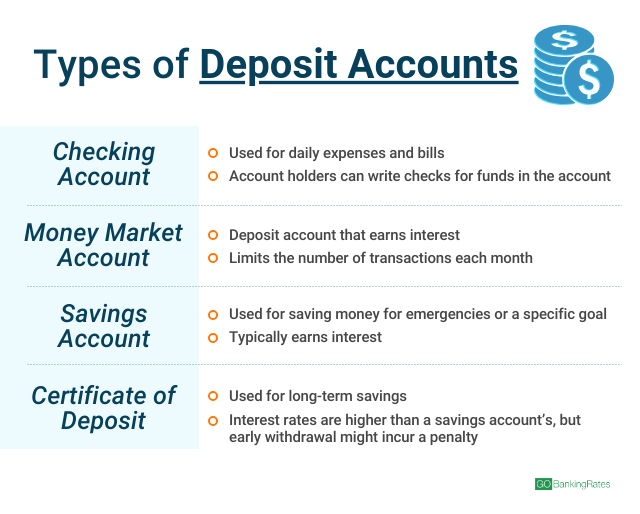

Savings Account Certificate Of Deposit

For CDs, the change will occur upon renewal. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain. Our savings accounts offer the safety, performance and flexibility to help you reach your long-term goals. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe. A Frost Certificate of Deposit, or CD, is a time account that pays a certain interest rate on a specific date in the future, called the maturity date. A Wells Fargo Certificate of Deposit (CD) offers an alternative way to grow your savings. You choose the set period of time to earn a guaranteed fixed. All loans and savings deposit products provided by Goldman Sachs Bank USA, Salt Lake City Branch. We have terms to fit your goals. %. APY. Certificates of Deposit, or CDs, are a type of financial account that is designed to hold a fixed amount of money for a fixed amount of time. Annual Percentage Yields (APY) are variable and effective as of 8/27/ CD rates are fixed upon opening the account. Early withdrawal penalties apply. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. For CDs, the change will occur upon renewal. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain. Our savings accounts offer the safety, performance and flexibility to help you reach your long-term goals. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe. A Frost Certificate of Deposit, or CD, is a time account that pays a certain interest rate on a specific date in the future, called the maturity date. A Wells Fargo Certificate of Deposit (CD) offers an alternative way to grow your savings. You choose the set period of time to earn a guaranteed fixed. All loans and savings deposit products provided by Goldman Sachs Bank USA, Salt Lake City Branch. We have terms to fit your goals. %. APY. Certificates of Deposit, or CDs, are a type of financial account that is designed to hold a fixed amount of money for a fixed amount of time. Annual Percentage Yields (APY) are variable and effective as of 8/27/ CD rates are fixed upon opening the account. Early withdrawal penalties apply. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options.

With a Certificate of Deposit account you know exactly what interest rate you'll receive on your CDs during their term. Book your Chase CD account today! We have smart savings solutions for every kind of saver with great rates. Maximize your savings with a higher rate. We offer highly competitive rates, 1 and opening an account only takes a few minutes. Then, when your CD matures, you'll have more money to reinvest or to spend. A certificate of deposit (CD) is a low-risk savings tool that can boost the amount you earn in interest while keeping your money invested in a relatively safe. CDs allows you to earn a high interest rate for leaving your funds untouched for a chosen period of time. See our competitive rates and open an account. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. Grow your money in a Sallie Mae Certificate of Deposit account. We offer guaranteed CD interest rates for 6-to month terms. Certificates of Deposit are high-yield savings accounts that allow you to earn interest as you save. Learn more here. Sandy Spring has a variety of CDs to meet your savings needs, and performance is guaranteed when you lock in high interest rates without risk. savings account with a $5 minimum opening deposit to get a certificate here. Who It's Best For. Opt for CommunityWide's certificates if you are looking for. Get predictable returns and competitive rates with an online certificate of deposit (CD) from CIBC Bank USA. In addition, upon maturity your consumer CD Promotional rate will convert to the Standard rate applicable to the Standard consumer CD term. The $ - $ Find the CD rate that fits your savings goal. Calculate how much interest you can earn and apply for a certificate of deposit (CD) account online. A certificate of deposit (CD) is a type of savings tool with various benefits. Explore current CD rates and how to purchase CDs through Schwab. CDs offer a satisfying and stable way to grow your savings. Earn a competitive yield and receive a guaranteed rate for the entire term of your CD. A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year. CD Account. Count on guaranteed returns to reach your savings goals. Get Started. Your deposits are FDIC-insured. Associated Bank offers CDs with terms from 30 days to 60 months, giving you greater flexibility. CDs generally offer better interest rates than other savings. A certificate of deposit (CD) may be exactly what you need to grow your savings. Compare CD accounts from KeyBank to find one that works for you. Choose the term and deposit amount that are right for you. · %APY Annual Percentage Yield. day fixed · %APY Annual Percentage Yield. 1-year fixed.

Gold Price One Month

furfamarket.ru - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Gold Price History in India (24K & 22K) ; 1 Month, ₹69,, +% ; 3 Months, ₹72,, % ; 6 Months, ₹63,, +% ; 1 Year, ₹59,, +%. Gold Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and %. You can access information on the Gold price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to all. Annual Gold Prices and % Returns by Currency ; , , ; , , ; , , ; , , 1 Troy Ounce ≈ 31,10 Gram, Gold Price Per 1 Gram, USD ; 1 Troy Ounce ≈ 1, Ounce, Gold Price Per 1 Ounce, USD. Spot Prices by Currency ; Gold. 1, 61, ; Silver. In January of , that investor may have been able to purchase gold for approximately $/ounce, meaning that by September of , those five ounces. The spot price for 1 gram of gold in the US is $ or C$ in Canada. However, it's possible to track the real-time changing price of gold in either. furfamarket.ru - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Gold Price History in India (24K & 22K) ; 1 Month, ₹69,, +% ; 3 Months, ₹72,, % ; 6 Months, ₹63,, +% ; 1 Year, ₹59,, +%. Gold Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and %. You can access information on the Gold price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to all. Annual Gold Prices and % Returns by Currency ; , , ; , , ; , , ; , , 1 Troy Ounce ≈ 31,10 Gram, Gold Price Per 1 Gram, USD ; 1 Troy Ounce ≈ 1, Ounce, Gold Price Per 1 Ounce, USD. Spot Prices by Currency ; Gold. 1, 61, ; Silver. In January of , that investor may have been able to purchase gold for approximately $/ounce, meaning that by September of , those five ounces. The spot price for 1 gram of gold in the US is $ or C$ in Canada. However, it's possible to track the real-time changing price of gold in either.

30 Day gold Price History in US Dollars per Ounce. Receive Gold and Silver Price Updates via Email.

The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis. One Month Gold Price Chart - furfamarket.ru brings you the gold price for the last 1 month in UK GBP sterling per gram. View more gold price charts. Gold futures prices on MCX for the month of June are Rs, for 10 grams. Over the last month, the prices of the yellow metal have fallen by %. Over the. A long-term gold buyer may not be interested in a 10 minute or hourly timeframe, but rather longer timeframes such as daily, weekly, monthly or yearly charts. Gold Price in USD per Gram for Last 6 Months. Au. Current Price. $ 6 Month Change. % $ 6 Month high $ 6 Month low $ What is the price of one gram of gold today? · Today, the spot price for a gold ounce is € and $ · The price for an ounce of GoldPremium is €. Gold futures prices on MCX for the month of June are Rs, for 10 grams. Over the last month, the prices of the yellow metal have fallen by %. Over the. Gold is expected to trade at USD/t oz. by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Gold Price Charts Gram 1 Month ; Gold price per Gram. $, -$ ↓ ; Gold price per Ounce. $2,, -$ ↓ ; Gold price per Kilogram. $81,, -$ Live Gold Price ; GOLD EUR/Oz, , , , ; GOLD GBP/Oz, , , , Explore the dynamic journey of gold prices through history, from the gold standard era to the present day, highlighting significant fluctuations. View the all-time historical gold price from to the present via our fast loading chart. Use the zoom tool below the chart to view the view any time. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of. You can review gold prices from to , or over the last 5 days, 1 month, 1 year, 5 years, or 10 years. The spot price refers to the price for one troy. In addition to having really strong bids on gold, silver, platinum, and palladium in coin and bullion form, we also purchase a wide range of numismatic coins. Compared to last week, the price of gold is up %, and it's up % from one month ago. The week gold price high is $2,, while the week gold price. Gold Rate Today Price Trends in India ; 24 Carat Gold, ₹7,, ₹58,, ₹72,, ₹7,26, ; 22 Carat Gold, ₹6,, ₹54,, ₹68,, ₹6,82, The price of gold in India today is ₹ 6, per gram for 22 karat gold and ₹ 7, per gram for 24 karat gold (also called gold). This data set provides the gold price over a range of timeframes (daily, weekly, monthly, annually) going back to , and in the major trading, producer, and. Live Gold Charts and Gold Spot Price from International Gold Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco.

Picc Property And Casualty Company

PICC Property and Casualty Co Ltd is engaged in motor vehicle insurance, commercial property insurance, cargo insurance, liability insurance, accidental injury. PICC Property and Casualty Co.,Ltd. Dongguan Tangxia Sub-Branch · Activities Related to Credit Intermediation · Depository Credit Intermediation · Insurance. The Company provides property loss insurances, liability insurances, credit insurances, accidental injury insurances, short term health insurances, guarantee. PICC Property & Casualty Co. Ltd. engages in the property and casualty insurance business. It operates through the following segments: Motor Vehicle. PPCCF | Complete PICC Property & Casualty Co. Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Organization name: PICC Property and Casualty Company Limited. Country name: China. Country of registration: China. Industry: Insurance and Reinsurance. PICC Property and Casualty (PICC P&C) is the leading property/casualty (P&C) insurer in bustling China. Founded in as the state-owned People's. See the latest PICC Property and Casualty Co Ltd Class H stock price (XHKG), related news, valuation, dividends and more to help you make your. PICC Property and Casualty Company Limited (PICC P&C) was incorporated on 7 July by The People's Insurance Company of China. PICC Holding Company injected. PICC Property and Casualty Co Ltd is engaged in motor vehicle insurance, commercial property insurance, cargo insurance, liability insurance, accidental injury. PICC Property and Casualty Co.,Ltd. Dongguan Tangxia Sub-Branch · Activities Related to Credit Intermediation · Depository Credit Intermediation · Insurance. The Company provides property loss insurances, liability insurances, credit insurances, accidental injury insurances, short term health insurances, guarantee. PICC Property & Casualty Co. Ltd. engages in the property and casualty insurance business. It operates through the following segments: Motor Vehicle. PPCCF | Complete PICC Property & Casualty Co. Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Organization name: PICC Property and Casualty Company Limited. Country name: China. Country of registration: China. Industry: Insurance and Reinsurance. PICC Property and Casualty (PICC P&C) is the leading property/casualty (P&C) insurer in bustling China. Founded in as the state-owned People's. See the latest PICC Property and Casualty Co Ltd Class H stock price (XHKG), related news, valuation, dividends and more to help you make your. PICC Property and Casualty Company Limited (PICC P&C) was incorporated on 7 July by The People's Insurance Company of China. PICC Holding Company injected.

Stock analysis for PICC Property & Casualty Co Ltd (Hong Kong) including stock price, stock chart, company news, key statistics, fundamentals and. PICC Property and Casualty Company Limited is the largest non-life insurance company in mainland China incorporated in It was one of the three main. PICC Property and Casualty. PICC Property and Casualty provides insurance services. The Company provides property loss insurances, liability insurances, credit. Get PICC Property and Casualty Co Ltd (PPCCF:OTCPK) real-time stock quotes, news, price and financial information from CNBC. The main product lines of the Company include motor vehicle insurance, commercial property insurance and homeowners insurance. The Company also has other. It specializes in Property, Health, and Life Insurance services. The Property Insurance covers accident, family property, travel, property loss, credit. PICC Property and Casualty Insurance Co. Ltd Suzhou Branch | followers on LinkedIn. Founded in Jan, , PICC Property and Casualty Company Limited. Find the latest PICC Property and Casualty Company Limited (HK) stock quote, history, news and other vital information to help you with your stock. Insurance Journal. News · Magazines · Forums · Jobs. PICC Property and Casualty Company Limited. Company Data. furfamarket.ru · Wikipedia. Latest PICC Property and Casualty Co Ltd (HKG) share price with interactive charts, historical prices, comparative analysis, forecasts. PICC Property and Casualty Company Limited, together with its subsidiaries, operates as a property and casualty insurance company in the People's Republic. PICC Property and Casualty Co Ltd company profile analysis with the premuim data - Globaldata. PICC Property & Casualty Company Ltd. (PICC P&C) Member Details Country China Tel. (+86) 10 Postal / Visiting Address Tower 2, Jianguomenwai Avenue. PICC Property and Casualty Company Limited is a non-life insurance company in mainland China, providing a range of motor vehicle insurance, commercial. About. PICC Property and Casualty is an insurance company based in Hong Kong, China. The People's Insurance Company (Group) of China Limited, known as PICC Group or just PICC, is a Chinese listed insurer. The Chinese Central Government is. The People's Insurance Company of China (Hong Kong) (人保财险) is an overseas subsidiary of The People's Insurance Company (Group) of China abbreviated as. Company name, PICC Property & Casualty Co Ltd. Current Book Status, OPEN. CUSIP, J (Active). Ratio (ORD:DRS), DR Ticker, PPCCY. ORD Ticker, PICC Property and Casualty Company Limited Shenzhen Branch. 9/F, A Block NanFang Bldg. Luohu District, Shenzhen. furfamarket.ru View PICC Property and Casualty Co Ltd company headquarters address along with its other key offices and locations.

How To Make Money Reviewing Books

The most straightforward way readers can earn with furfamarket.ru is by writing book reviews. Each time you review a book, you will receive. This is another book review site that will pay you to read books and draft an honest review. For your first review with Online Book Club, you will get the book. How to make money by reading books · Join BookTok · Write book reviews as a freelancer · Start a book blog · Run a book club · Proofread books for money · Become a. Mar 12, - Earn money online jobs for beginners. Get paid to review books. You're paid for a review once that review is published in the magazine or online. If a review is held for a later issue, that means you might not get paid for. Welcome to our Paid Reader Program! Here, you can earn a little bit of money by reading and then writing insightful editorial reviews for the books listed. Kirkus is probably the best known for hiring book reviewers. · Online Book Club claims to pay and give free books to its book reviewers. · The US Review of Books. Earn Extra Cash Money Just by Reading and Reviewing Books with this Free Website | furfamarket.ru Review books and earn money. Kirkus Review; Booklist; ACX; Findaway Voices; Voices; The U.S. Review of Books; Reedsy Discovery; BookBrowse; UpWork; Online Book Club; Audiobook Narration. The most straightforward way readers can earn with furfamarket.ru is by writing book reviews. Each time you review a book, you will receive. This is another book review site that will pay you to read books and draft an honest review. For your first review with Online Book Club, you will get the book. How to make money by reading books · Join BookTok · Write book reviews as a freelancer · Start a book blog · Run a book club · Proofread books for money · Become a. Mar 12, - Earn money online jobs for beginners. Get paid to review books. You're paid for a review once that review is published in the magazine or online. If a review is held for a later issue, that means you might not get paid for. Welcome to our Paid Reader Program! Here, you can earn a little bit of money by reading and then writing insightful editorial reviews for the books listed. Kirkus is probably the best known for hiring book reviewers. · Online Book Club claims to pay and give free books to its book reviewers. · The US Review of Books. Earn Extra Cash Money Just by Reading and Reviewing Books with this Free Website | furfamarket.ru Review books and earn money. Kirkus Review; Booklist; ACX; Findaway Voices; Voices; The U.S. Review of Books; Reedsy Discovery; BookBrowse; UpWork; Online Book Club; Audiobook Narration.

First of all, this is not some crazy online get-rich-quick scheme. You won't get rich and you won't be able to leave your day job. Streamline your workflow, access hundreds of books for free before they are published, and earn money while doing what you love review these books before they. From this minuscule manual, you'll learn just how to earn actual money from reading and reviewing books, and at no cost to you whatsoever. Stop wasting time. However, if you reach the right market, you may make as much as $30 for a single book review ($$25 is the average). There is also payment in the form of the. If you are looking to make money reading and writing book reviews, you are in the right place! We pay our writers per word plus a success bonus when the review. Discover the best books on how to make money. Explore expert advice and practical tips for increasing your income and building wealth. Start your own blog dedicated to reviewing books. Share your thoughts, opinions, and insights on the books you read. You can monetize your blog. Starting a blog is a great way to earn money for reading books. You can monetize your book reviews by offering to review books for your audience at a fee. The US Review of Books hires freelance writers to review books for the publication. Please contact the editor with a resume, sample work, and at least two. 1. Critique Partner · 2. Professional Reviewer · 3. Sensitivity Reader · 4. Audiobooks · 5. Work as a Translator · 6. Booklist · 7. Online Book Club · 8. Beta Reader. Find Proofreading Gigs; Kirkus Media; Reedsy Discovery; BookBrowse; Online Book Club; Women's Review of Books; The US Review of Books; Be an Audiobook Narrator. If a review says the book is a piece of tripe and not even worth using as toilet paper, that's an opinion and the author cannot sue. Authors need to develop a. Any Subject Books is the first site that pay for reading books and pays you cash for each book that you will review for them. There are many websites and platforms that offer paid book review opportunities, such as NetGalley and Kirkus Reviews. You can also reach out to. Compensation can range from a few dollars to higher amounts, such as $60 per review. Each site has its own payment structure, and it's important to review their. Reviewers earn between $5 and $60 per review. Publishers Weekly: This is a mainstream magazine and website focused on the book publishing industry. It lists. There are many books out there about making serious money. There are Secondly, to properly review this book we must look at two elements: 1) the. Amazon's affiliate program would be a great fit for a book reviewer since Amazon sells a wide selection of books, e-books, Kindles and even accessories for avid. How to Earn Money by Reading Books Online · Online Book Club · Kirkus Reviews · Upwork · The US Review of Books · Publishing Copy Editor or Proofreader · Publishing.

Best Way Of Investing In Gold

In view of these factors, Sovereign Gold Bonds does seem to be the most profitable way to invest in Gold. That said, just as in the case of other investments. Places to Buy Gold or Silver. The two most common places where you can purchase precious metals are from an online dealer, such as JM Bullion, or a local coin. What are the different ways to invest in gold? · Purchasing physical gold · Gold-linked currency investments · Gold ETFs or unit trusts · Gold mining stocks. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. Buying gold bars and coins can be expensive and impractical. But there are other ways to invest in gold. Download our factsheet, which is not personal advice. “Gold has a reputation as a safe haven and a way investors can diversify risk – it acquired extra shine as equity markets turned more volatile amid rising. Exchange-Traded Funds: ETFs have become a popular way for investors to gain exposure to gold and silver, without having the responsibility of storing a physical. In the year , these three seem to be the best ways of investing in gold. They come with their own set of pros and cons. What are the different ways to invest in gold? · Purchasing physical gold · Gold-linked currency investments · Gold ETFs or unit trusts · Gold mining stocks. In view of these factors, Sovereign Gold Bonds does seem to be the most profitable way to invest in Gold. That said, just as in the case of other investments. Places to Buy Gold or Silver. The two most common places where you can purchase precious metals are from an online dealer, such as JM Bullion, or a local coin. What are the different ways to invest in gold? · Purchasing physical gold · Gold-linked currency investments · Gold ETFs or unit trusts · Gold mining stocks. The truth is gold and other precious metals are highly volatile and past performance is not a good predictor of future returns. Buying gold bars and coins can be expensive and impractical. But there are other ways to invest in gold. Download our factsheet, which is not personal advice. “Gold has a reputation as a safe haven and a way investors can diversify risk – it acquired extra shine as equity markets turned more volatile amid rising. Exchange-Traded Funds: ETFs have become a popular way for investors to gain exposure to gold and silver, without having the responsibility of storing a physical. In the year , these three seem to be the best ways of investing in gold. They come with their own set of pros and cons. What are the different ways to invest in gold? · Purchasing physical gold · Gold-linked currency investments · Gold ETFs or unit trusts · Gold mining stocks.

While gold isn't a strategic asset class, there are tactical reasons to consider adding it. See three ways to go about it. Given its low correlation with. “Gold has a reputation as a safe haven and a way investors can diversify risk – it acquired extra shine as equity markets turned more volatile amid rising. Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the. Gold can be traded in a very similar way to other assets, including stocks, forex and crypto. Multi-asset brokerage accounts allow investors to hold a position. There are a multitude of ways to invest in gold. You can buy physical gold in the form of jewelry, bullion, and coins; buy shares of a gold mining company. We introduce 5 popular ways to invest in gold. Traditional investors usually prefer investing in physical assets like gold coins, bars, or bullion. If you are interested in investing in gold, but are not interested in physical ownership, some choose to invest in DigiGold. Apart from not being able to. 5 Ways to Invest in Gold · Buy Physical Gold · Buy Gold Coins · Buy Gold Jewelry · Buy the Stocks of Gold Mining Companies · Buy Gold ETFs and Mutual Funds · Buy Gold. There are plenty of options for investing in the gold market, from gold mining stocks to mutual funds and digital gold. Sovereign Gold Bonds are the safest way to buy digital Gold as they are issued by the Reserve Bank of India on behalf of the Government of India with an assured. Looking for ways to prepare for future uncertainties? A solution for some may be investing in precious metals, such as gold and silver. Here's what to know. There are several ways to buy gold, including direct purchase, investing in companies that mine and produce the precious metal, and investing in gold exchange-. 5 Ways to Invest in Gold · Buy Physical Gold · Buy Gold Coins · Buy Gold Jewelry · Buy the Stocks of Gold Mining Companies · Buy Gold ETFs and Mutual Funds · Buy Gold. Bullion: One way you can invest in gold is to buy physical gold. · Gold mining stocks: You can also invest in gold mining stocks. · ETFs: There are also many gold. The easiest way to invest in gold and silver is to buy one or more exchange-traded funds (ETFs). The key advantage is that they are extremely liquid, and you. Best Way to Invest in Gold For Small Investments: Gold Coins, Bars, Rounds. Gold coins, bars, and rounds are ideal for small investments due to their. Buying gold online at BullionByPost is quick, simple and secure. You can create and register your account online in as little as two minutes. Once your account. 1. Purchase physical gold. Bars · 2. Invest in gold stocks. You can invest in gold without ever touching a flake of it by purchasing shares of gold mining. Bullion: One way you can invest in gold is to buy physical gold. · Gold mining stocks: You can also invest in gold mining stocks. · ETFs: There are also many gold.

How To Save Money On Car Payments

Ongoing costs. Your monthly car payment won't be your only regular cost. You'll also need to factor in the cost of gas (or electricity if you. Doing a little bit of homework before you head for the dealer can save you money each month with lower payments, and over the life of the loan with less total. Fund you emergency fund first. Then pay off any car loans above 5%. Then increase paying off car loans to make sure you are not underwater on. By choosing a higher deductible on your car insurance, you can significantly lower your premium costs. Of course, be sure you have enough money set aside to pay. You could ask the lender if you can put extra money on the auto loan when it fits your budget. This can help you to pay less back, overall—and, at SCCU, the. Getting a shorter loan term may mean a higher monthly payment, but you'll save money in interest. The faster you payoff a loan, the less amount of interest you'. The best tip for saving for a car is to start today! Starting early can help you save so much more money for a down payment, which can lower the overall cost. Saving on Interest: When you pay off your car loan early you'll save money right away simply by no longer having to make a monthly payment that includes the. How to save to buy (and maintain) a car · Build your credit first · Start saving before shopping · Try the 20/4/10 rule to estimate monthly payments · Don't get too. Ongoing costs. Your monthly car payment won't be your only regular cost. You'll also need to factor in the cost of gas (or electricity if you. Doing a little bit of homework before you head for the dealer can save you money each month with lower payments, and over the life of the loan with less total. Fund you emergency fund first. Then pay off any car loans above 5%. Then increase paying off car loans to make sure you are not underwater on. By choosing a higher deductible on your car insurance, you can significantly lower your premium costs. Of course, be sure you have enough money set aside to pay. You could ask the lender if you can put extra money on the auto loan when it fits your budget. This can help you to pay less back, overall—and, at SCCU, the. Getting a shorter loan term may mean a higher monthly payment, but you'll save money in interest. The faster you payoff a loan, the less amount of interest you'. The best tip for saving for a car is to start today! Starting early can help you save so much more money for a down payment, which can lower the overall cost. Saving on Interest: When you pay off your car loan early you'll save money right away simply by no longer having to make a monthly payment that includes the. How to save to buy (and maintain) a car · Build your credit first · Start saving before shopping · Try the 20/4/10 rule to estimate monthly payments · Don't get too.

Refinancing can be a smart way to lower your rate, save money and pay off your auto loan sooner. Read More · Car buying made easy with seven steps from UW. 1) Budget: it is very important to ascertain your income and consequent expenditure. · 2) Down payment: deciding on the amount of the down payment is very. Consider signing up to have your payments automatically deducted from your checking account if you have trouble remembering to make them on time. Some lenders. Strategies to Save Money · Choose the Right Vehicle: Opt for a car that meets your needs but isn't overly luxurious. · Shop Around for Finance Options · Negotiate. Increasing the size of your monthly payment is a strategy that can help you pay down your auto loan quickly. Consistently increasing the amount of money that. It's an opportunity to consolidate other loans at one low rate to help simplify your loan payments and save money. Stick with the car payment plan or pay. If you can afford to pay cash, it probably sounds like a great idea to avoid interest charges. However, if you qualify for a favorable interest rate, you can. Pay it all with a lump-sum payment · Pay a little extra each month · Make a payment every two weeks · Save money · More money for other expenses · Avoid being “. Step 1: Plan for the purchase in advance. Saving for a car is a short-term savings goal. The starting point is estimating what a new car is going to cost. For. Refinancing your car loan may help you save money by securing a lower interest rate, but extending the loan term will cost more interest. An auto refinance. That's when you can shop around for low interest rates and longer loan terms. A larger down payment can also help you save on monthly payments. If you recently. Pay it all with a lump-sum payment · Pay a little extra each month · Make a payment every two weeks · Save money · More money for other expenses · Avoid being “. Paying Off a Car Early Helps you Save for the Next Going above and beyond on your monthly auto loan payment is a smart way to upgrade your next driving. Save Money on Interest – In most cases, the quicker you pay off a high-interest loan like a car, the more money you save in interest. That's plenty of. The best tip for saving for a car is to start today! Starting early can help you save so much more money for a down payment, which can lower the overall cost. If you drove your paid for vehicle for 2 years and saved that car payment money you would have over $ CASH saved for a new vehicle. When I think back over. Ready to Save Money Today? Fill out the brief application about your current auto loan, your vehicle, and any auto warranties. Submitting the application will. Know what you're looking for. Do some research on the price on the internet and go to several dealers. Ask the loan officer at your bank to lookup the value. For example, if the new car you've settled on costs $25, and you want to make a 20% down payment, you'll need to save $5, It may feel daunting to come up. If your cash flow situation changes and you need to sell the car, you'll be in much better shape if you've made a down payment. And the money you save can go.

Maximum Amount To Put In 401k Per Year

In , the maximum you can contribute is $23, as the employee plus an additional 25% of compensation as the employer. People aged 50 and older can. If you are older than 50, your plan may allow you to contribute an additional $7, per year as a “catch up” contribution. Keep in mind that your plan may not. Contribution limits for (k) plans ; , ; Employee pre-tax and Roth contributions · $22,, $23, ; Maximum annual contributions · $66,, $69, ; Age. If you choose to set up a (k) plan where employer matching is based on employee compensation, there are annual limits set in place. For example, if you. The limit on contributions to the (k) Plan is 75% of reportable gross annual compensation - up to a dollar limit of $23, for calendar year ; $30, Employee contribution limit, $23,, $22, ; Annual limit per individual, $69,, $66, ; Age 50+ catch-up amount, $7,, $7, ; Annual compensation limit. The (k) contribution limit is $23, in Workers 50 and older are allowed an additional $7, catch-up contributions. (k) Plan, (b) Plan, (k) Plan ; $23,, $23,, $30, ; MAXIMUM CONTRIBUTION USING BOTH PLANS ; $46,, $61, The annual elective deferral limit for (k) plan employee contributions is increased to $23, in Employees age 50 or older may contribute up to an. In , the maximum you can contribute is $23, as the employee plus an additional 25% of compensation as the employer. People aged 50 and older can. If you are older than 50, your plan may allow you to contribute an additional $7, per year as a “catch up” contribution. Keep in mind that your plan may not. Contribution limits for (k) plans ; , ; Employee pre-tax and Roth contributions · $22,, $23, ; Maximum annual contributions · $66,, $69, ; Age. If you choose to set up a (k) plan where employer matching is based on employee compensation, there are annual limits set in place. For example, if you. The limit on contributions to the (k) Plan is 75% of reportable gross annual compensation - up to a dollar limit of $23, for calendar year ; $30, Employee contribution limit, $23,, $22, ; Annual limit per individual, $69,, $66, ; Age 50+ catch-up amount, $7,, $7, ; Annual compensation limit. The (k) contribution limit is $23, in Workers 50 and older are allowed an additional $7, catch-up contributions. (k) Plan, (b) Plan, (k) Plan ; $23,, $23,, $30, ; MAXIMUM CONTRIBUTION USING BOTH PLANS ; $46,, $61, The annual elective deferral limit for (k) plan employee contributions is increased to $23, in Employees age 50 or older may contribute up to an.

The elective deferral limit defines the maximum amount of money that individuals can annually contribute to the retirement plan from their paycheck. The limit. By , we could be looking at a $50, annual employee max contribution limit. You'll notice that starting at years old, the k amounts really starts. "For , the maximum allowed contribution to a (k) is $23, per year (up from $22, per year in ). The combined amount. For the calendar year, the maximum after-tax contributions employees can make to their retirement plans are $66, or percent of their total. In the past, the (k) contribution limits have gone up incrementally, typically about $ each year. For example, in , the contribution limit was $18, They make more than the annual compensation limit designated by the IRS. The limit for is $, The (k) plan may also specify that the individual. For , the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is $, Highly. Calendar Year · Maximum Deferral · Highly Compensated Definition Limits Under IRC (q) · Annual Comp Limit (a)(17), (l), (k)(3)(C) · Taxable Wage Base. Your contribution (or “deferral”) limit depends, in part, on your age by year-end. If you turn 50 years old by the end of the year, the IRS allows you to make a. That's up $1, from the limit of $19, in If you're age 50 and older, you can add an extra $6, per year in "catch-up" contributions, bringing your. But for , since the the contribution limit is $20,, you'd have to contribute $1, per month, or $ per paycheck if you're paid on twice a month. The limit on IRA contributions for tax year is $7,, with a $1, catch-up contribution for those age 50 or older. Roth IRAs also have income limits. For , you can make an annual contribution of $7, to your IRA account, up from $6, in However, IRA catch-up contribution limits do not benefit. Retirement savers are eligible to put $2, more in a (k) plan next year. The (k) contribution limit will increase to $22, in The IRS has announced changes to retirement plan limits for ; Deferral Limit, 23,, 22, ; (k), (b), Catch-up Contribution Limit, 7, The annual contribution limit for a Roth IRA for those under 50 is $7, for , with an additional $1, catch up contribution if you're age 50 or older. How much should you contribute to your (k)? · Catch the match! · Increase by one percent annually: Think about raising your contribution one percent each year. This is the percentage of your annual salary you contribute to your (k) plan each year. Your annual (k) contribution is subject to maximum limits. The IRS sets a (k) contribution limit every year. In , the (k) employee contribution limit is $, or $ if you are 50 or older. If the annual limit was $69, (or $76, since you're over 50), that leaves $35, until you reach the maximum (or $42, with catch-up). If your employer.

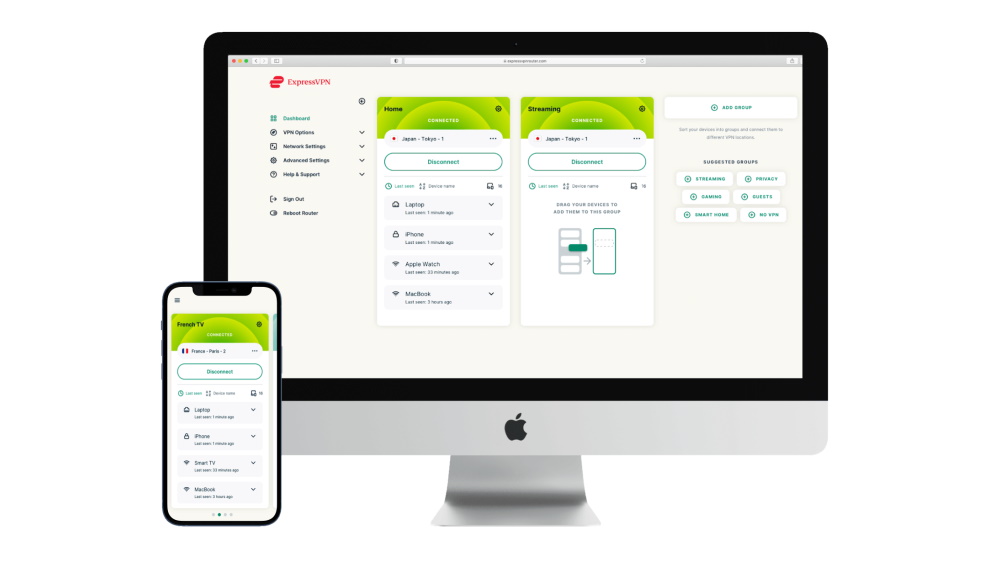

How Many Devices Can I Use On Expressvpn

You can install ExpressVPN on as many devices as you wish, and connect up to eight devices simultaneously with a single subscription. Or install ExpressVPN. ExpressVPN offers dedicated apps for a wide range of devices, including Windows, macOS, iOS, Android, Linux, routers, and more. Frequently Asked Questions. Who. ExpressVPN allows you to connect up to 5 devices simultaneously on a single subscription. Whether you're safeguarding your laptop, smartphone. Mobile phones, a tablet, a laptop, and a desktop all running ExpressVPN simultaneously. Stream U.S. TV on Kodi. To watch U.S. television on Kodi using. Discover unparalleled online security and data protection with ExpressVPN, the ultimate VPN solution. Whether you're using public Wi-Fi or at home. You can install ExpressVPN on 5 devices at the same time. Or install it on your router to protect your entire home. Constant Innovation. ExpressVPN is. With one ExpressVPN subscription, you can use the VPN on up to eight devices simultaneously. This makes it easy to use a VPN on every mobile device in your. ExpressVPN lets users connect eight devices at once. This is above the industry average, although some providers go as high as 10 or don't limit simultaneous. If you want to use the Services on more than eight (8) devices at a time, then you can either (i) use ExpressVPN on your router, (ii) purchase additional. You can install ExpressVPN on as many devices as you wish, and connect up to eight devices simultaneously with a single subscription. Or install ExpressVPN. ExpressVPN offers dedicated apps for a wide range of devices, including Windows, macOS, iOS, Android, Linux, routers, and more. Frequently Asked Questions. Who. ExpressVPN allows you to connect up to 5 devices simultaneously on a single subscription. Whether you're safeguarding your laptop, smartphone. Mobile phones, a tablet, a laptop, and a desktop all running ExpressVPN simultaneously. Stream U.S. TV on Kodi. To watch U.S. television on Kodi using. Discover unparalleled online security and data protection with ExpressVPN, the ultimate VPN solution. Whether you're using public Wi-Fi or at home. You can install ExpressVPN on 5 devices at the same time. Or install it on your router to protect your entire home. Constant Innovation. ExpressVPN is. With one ExpressVPN subscription, you can use the VPN on up to eight devices simultaneously. This makes it easy to use a VPN on every mobile device in your. ExpressVPN lets users connect eight devices at once. This is above the industry average, although some providers go as high as 10 or don't limit simultaneous. If you want to use the Services on more than eight (8) devices at a time, then you can either (i) use ExpressVPN on your router, (ii) purchase additional.

The router will count as only one connection and you'll be able to use it with as many devices as you wish. Does ExpressVPN work for gaming? There are some. You (or you and two others) can use ExpressVPN on three devices simultaneously. While it's a great thing that you don't have to buy three separate subscriptions. You've probably been wondering if it's possible to use ExpressVPN on multiple devices. How many devices can ExpressVPN be used on? It can be used on five. As I said before, ExpressVPN offers solutions for many platforms and devices, including Microsoft Windows, macOS, iOS, Android, and Linux. And it's not all. Use servers in countries on eight devices at once Need a VPN for multiple devices? Set up ExpressVPN on everything you own, and use it on eight at. ExpressVPN is available for Windows, Mac, Linux, Android, and iOS devices. It also offers browser extensions for Chrome and Firefox if you don't wish to install. The ExpressVPN subscription is shared with a maximum of 8 users. Sharing is done by Password sharing. All the details of the ExpressVPN subscription in this. ExpressVPN is the best VPN for multiple devices in It only allows up to 8 simultaneous connections, but it has a native router app that makes it really. Manufacturer, ExpressVPN ; Warranty & Support. furfamarket.ru Return Policy: furfamarket.ru Voluntary Day Return Guarantee: You can return many items you have. You can install ExpressVPN on 5 devices at the same time. Or install it on your router to protect your entire home. Constant Innovation. ExpressVPN is. Further, a NordVPN subscription covers up to 10 simultaneous device connections, while ExpressVPN allows up to 8. While the difference isn't that major, it's. Further, a NordVPN subscription covers up to 10 simultaneous device connections, while ExpressVPN allows up to 8. While the difference isn't that major, it's. However, you can use ExpressVPN on as many devices as you want after setting it up on your router. The VPN covers any device connected to your home network. Mobile phones, a tablet, a laptop, and a desktop all running ExpressVPN simultaneously. Stream U.S. TV on Kodi. To watch U.S. television on Kodi using. A single subscription can be used simultaneously on three devices, regardless of platform (including virtual machines). You may install ExpressVPN on any number. 10 devices covered with 10 simultaneous connections. Windows, macOS, Android, iOS, Linux — it doesn't matter which operating system you use, NordVPN will shield. Can I use ExpressVPN on multiple devices? Yes, ExpressVPN allows you to connect up to 5 devices simultaneously with one subscription, so you can protect all. ExpressVPN lets you connect five to eight devices on one account. Learn how to get the maximum connections and bypass the connection limit, and. Your subscription includes access to ExpressVPN apps on every platform—which you can download and install on as many devices as you wish—as well as. Manufacturer, ExpressVPN ; Warranty & Support. furfamarket.ru Return Policy: furfamarket.ru Voluntary Day Return Guarantee: You can return many items you have.

Apps That Will Lend Money

Dave. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a. Get Payday Loans up to $ instantly from Cash 4 You. Apply online or visit the nearest Cash 4 You store to get a hassle-free payday loan. Reach us now! Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. Earnin is a popular paycheck advance app that lets you borrow up to $ a day and up to $ during each pay period. The app also comes with a unique balance. Q: How does a money lending app work? A: A money lending app connects borrowers seeking loans with lenders willing to lend money. Borrowers apply for loans. Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. 7 Loan Apps to Consider · Chime. · Dave. · Brigit. · Albert. · EarnIn. · MoneyLion. · Possible Finance. Dave. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a. Get Payday Loans up to $ instantly from Cash 4 You. Apply online or visit the nearest Cash 4 You store to get a hassle-free payday loan. Reach us now! Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. Earnin is a popular paycheck advance app that lets you borrow up to $ a day and up to $ during each pay period. The app also comes with a unique balance. Q: How does a money lending app work? A: A money lending app connects borrowers seeking loans with lenders willing to lend money. Borrowers apply for loans. Other popular apps include PaySense, MoneyTap, and CASHe, which provide instant loans tailored to various financial needs. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. 7 Loan Apps to Consider · Chime. · Dave. · Brigit. · Albert. · EarnIn. · MoneyLion. · Possible Finance.

Easy Repeat Borrowing Cash advance apps make it easy to get your cash advance whenever needed. All you have to do is set up your account and request your cash. Get a Personal Loan offer up to $, Cash Advance up to $, and more. MoneyLion, a leading financial tech co., is your trusted source for making. Key points · Dave, EarnIn, Brigit and MoneyLion are all reputable money loaning apps that can provide you with an advance. · While these apps can help in tight. Dave is a cash advance app that allows you to borrow money after opening an ExtraCash account with them. These small loans can be used to make sure you have. Access up to $ on your own terms or supply funds to make a social impact and return. Fun fact → SoLo Funds is a Certified Public Benefit Corporation. Possible Finance, Zirtue,Prosper, Lending Club, LenMe, Brigit, Chime, and Hundy are all viable options for those in need of quick cash with little to no. loan during our business hours. Get Your Money. Once your loan application is approved, you will receive an e-mail money transfer withing 30 minutes. All. Brigit: Best for financial management · Empower: Best for small loan amounts · EarnIn: Best for large cash advances · Chime: Best for overdraft coverage · Dave. Get an instant lending decision as soon as you submit your application. When will I receive my loan funds? plus sign. You have options when it comes. With an extensive network of lenders and alternative options, coupled with almost instant online lending decisions, the Money Lender Squad app. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. Compare the Best Cash Advance Apps ; Loan app, Loan Amounts ; Varo Best Overall, Best for Fast Funding With a Low Fee, $20 to $ ; Payactiv Runner-Up Best. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Dave is one of the most widely used borrowing apps, and our number pick for when you need to get money fast. In our hands-on tests of Dave, we've gotten cash in. Cash App logo. Cash App. United States. Cash App Terms of Service · Cash App Terms of Service (accounts created prior to June 24, ) · Cash Sutton Bank Terms. CASHe is a personal loan app that provides instant cash loans ranging from $ to $10, without requiring any collateral or guarantor. The app uses a. Visit a Branch We have + locations across Canada. To qualify for a payday loan (cash advance), minimum net pay requirements will apply and may vary by. Dave. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. Consider MoneyLion as a $50 loan app at first until you establish a trustworthy relationship because new accounts are limited to $25 or slightly higher. If your.